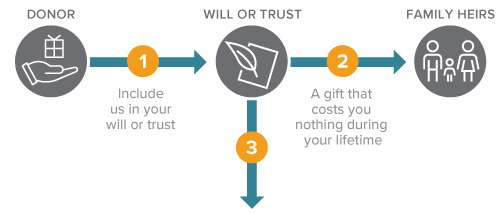

Gifts from Your Will or Trust

How It Works

- Include a gift to St. Joseph’s Children's Hospital Foundation in your will or trust. (Here is sample language for your will.)

- Make your bequest unrestricted or direct it to a specific purpose.

- Indicate a specific amount or a percentage of the balance remaining in your estate or trust.

Important Related Topics

Benefits

- Your assets remain in your control during your lifetime.

- You can modify your gift to address changing circumstances.

- You can direct your gift to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

- Under current tax law, there is no upper limit on the estate tax deduction for your charitable bequests.

Please let us know if you have already included St. Joseph’s Children's Hospital Foundation in your estate plan or if you are considering doing so. Thank you.

Please let us know if you have already included St. Joseph’s Children's Hospital Foundation in your estate plan or if you are considering doing so. Thank you.

Next

- More detail about gifts from your will or trust.

- Contact us so we can assist you through every step.